GLOBAL INVESTING

Since the Great Recession in 2008 the US stock market has outperformed international markets by a large margin. This has caused many portfolios to become overweighted in US stocks and some people have questioned if investing internationally still makes sense.

There are many decisions to be made when allocating your investments and the charts below provide information to keep in mind when deciding how to allocate your investments in the US and overseas.

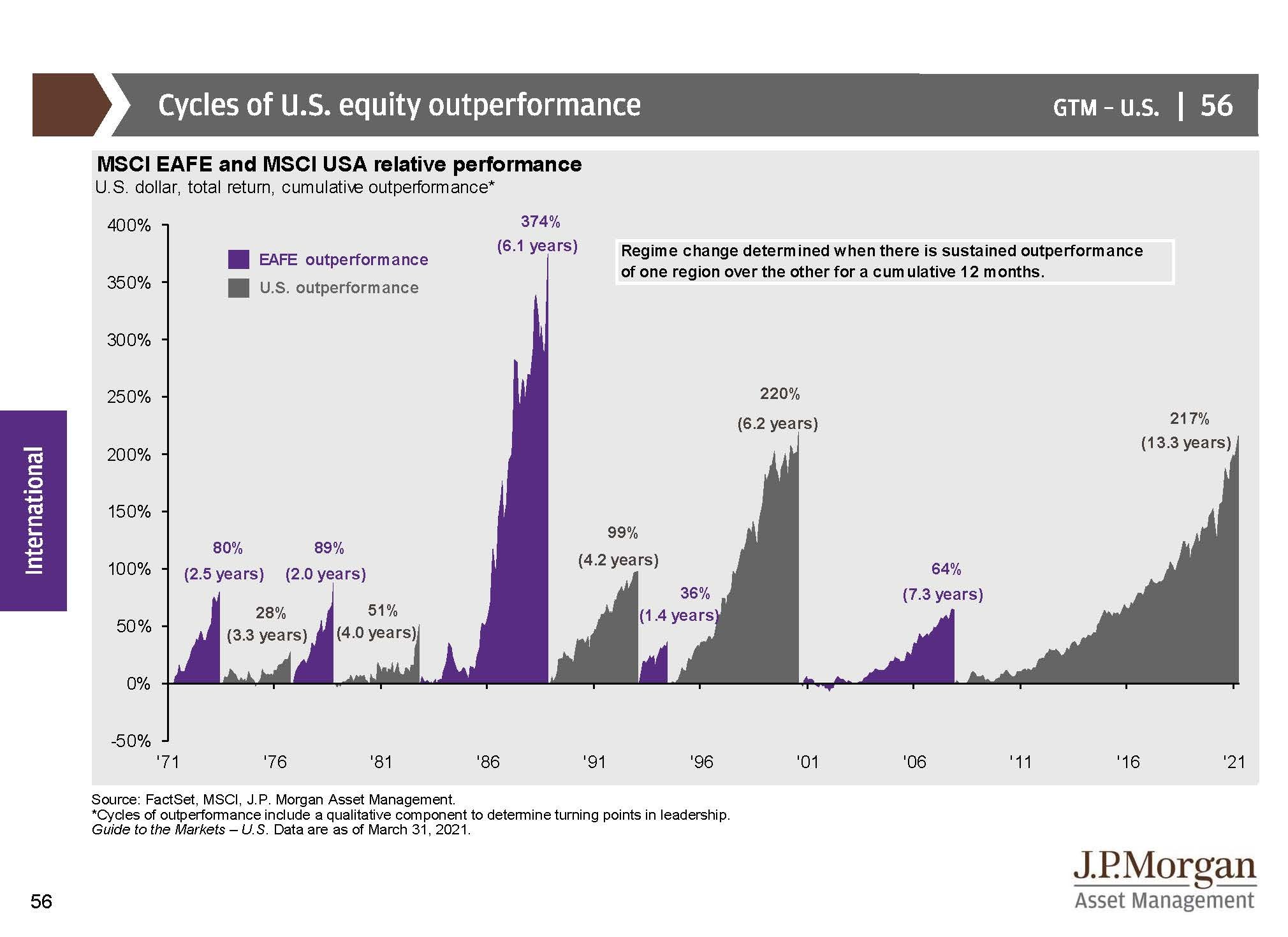

The first chart shows US and international markets have historically traded periods of outperformance. The gray area represents when the US has outperformed, which you can see it has done for over 13 years now, and the purple area indicates international outperformance.

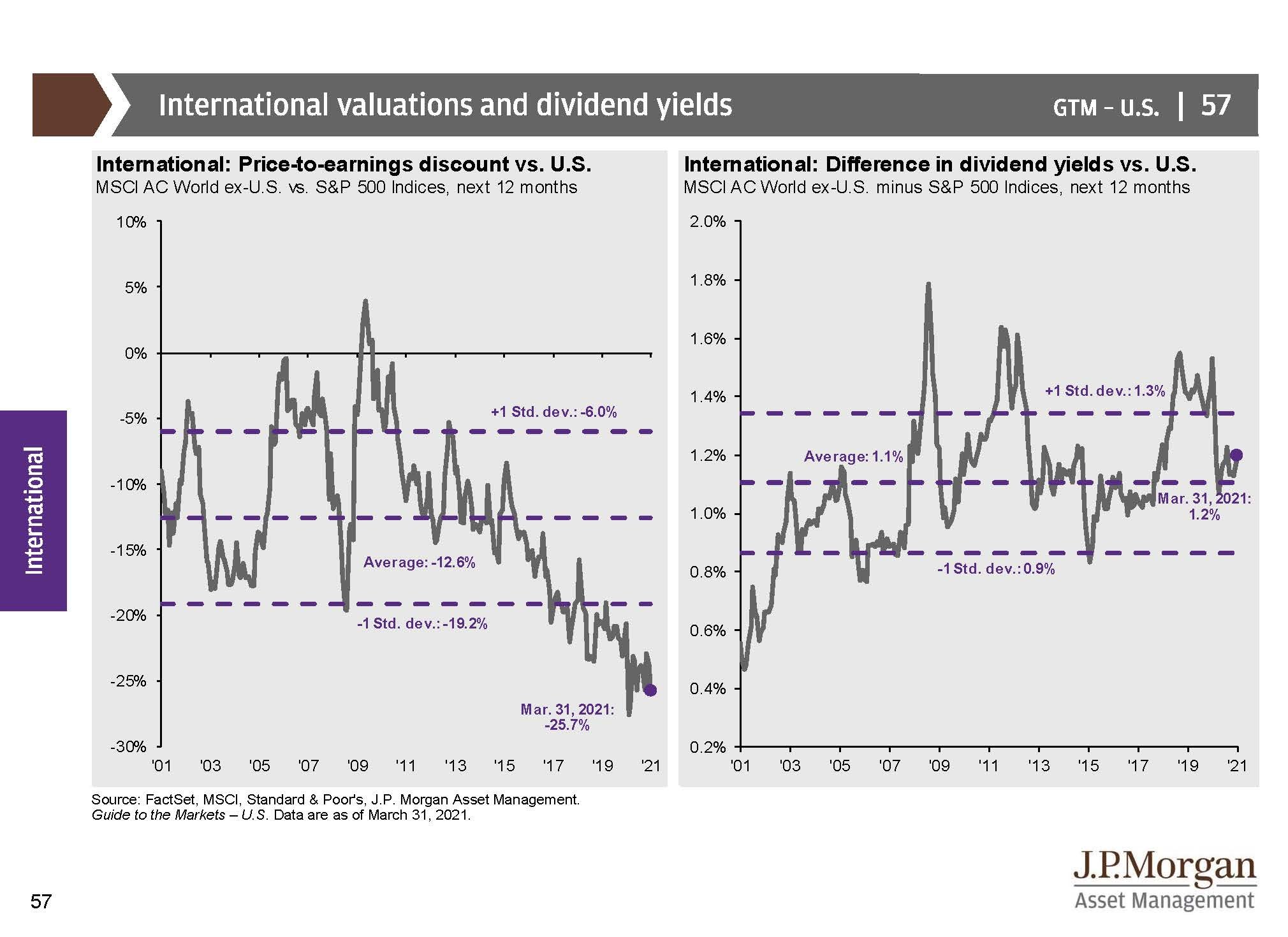

The next two charts show that the S&P 500 looks to be fairly expensive given a variety of measurements, while international markets look cheaper comparatively.

Keep in mind this is not a prediction that the tide is about to turn, I don’t know when a rotation of outperformance may shift. Rather, it is a reminder of how markets have worked in the past, and given these patterns tend to repeat themselves it will likely happen again.

Some may argue that holding a portfolio of just US stocks such as the S&P 500 would have outperformed holding a globally diversified portfolio over the last decade, which is true. It is also true that if you held a portfolio of only international stocks during the previous decade you would have done better than allocating any money in the US market. However, since getting the timing of these cycles right is nearly impossible, an allocation to each is recommended and adds diversification to a long-term investment portfolio. The downside to diversification is you may not be the biggest winner from year to year, however, the beauty is that you are also not the biggest loser and long-term you are likely to have a more consistent and rewarding experience.

If you would like to discuss international investing within your portfolio, please email me at advisor@blakegallion.com to schedule an appointment.

Advisory services offered through Arbor Point Advisors. Securities offered through Securities America Inc., Member FINRA/SIPC. Arbor Point and Securities America are separate companies. CA Insurance #0E88557