Q1 2023 Market Review

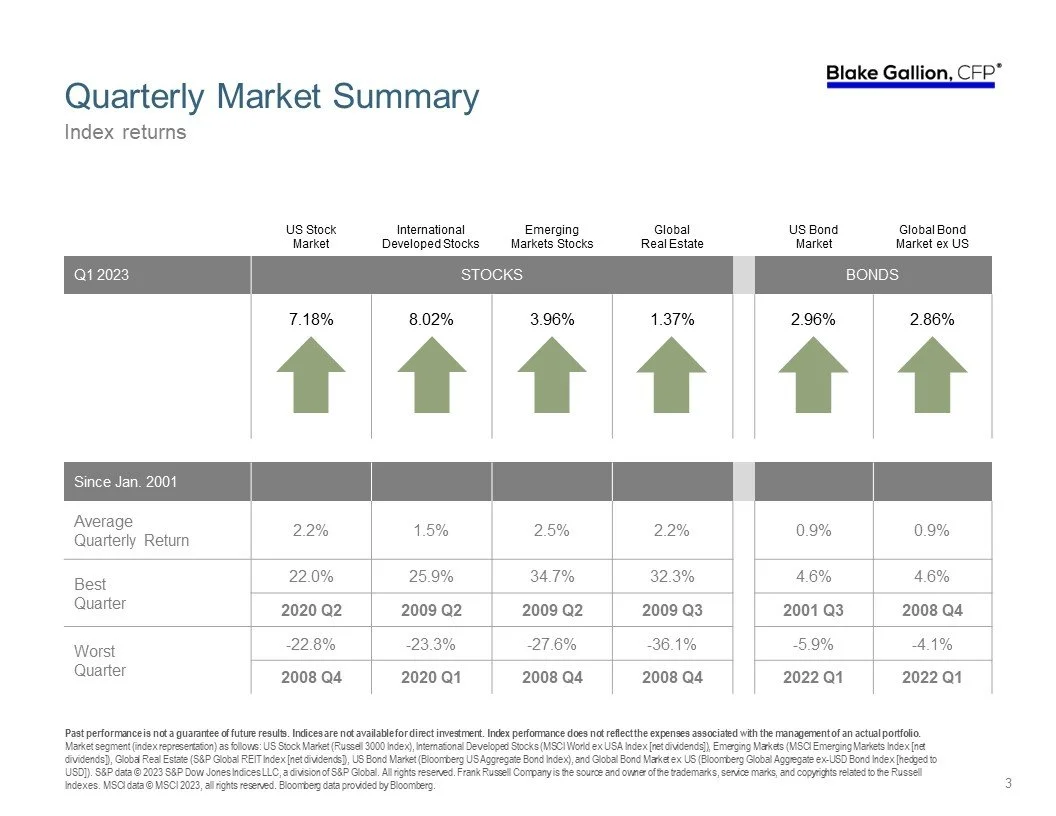

Coming off a tough 2022, Q1 of 2023 started the year in the right direction with positive returns across the board. International stocks lead the way with a gain of 8.02% followed by the US at 7.12%. Bonds also saw gains with 2.96% in the US and 2.86% globally outside of the US. This happened in spite of a difficult backdrop of rising interest rates, significant bank failures, and a continued sense of instability. Overall, the quarter was a good reminder to not abandon a sound investment strategy, as markets are unpredictable but rewarding over time.

For a detailed Market Overview, click here.

Planning Opportunity: With interest rates rising from around 0% to 5%, there are much better opportunities to earn interest on any cash you may have in the bank, as well as with fixed-income investments such as corporate bonds and treasuries. Of course, these opportunities have come about as a result of high inflation, which looks to be easing but is still too high. That said, making sure you make the most of the resources you have is an important part of achieving your financial objectives, so I encourage you to review any idle money to see if it can be doing more for you. If you would like to discuss this further, please email me at advisor@blakegallion.com.